The New Competitive Moat in Private Equity: Why Investor Experience Matters More Than Ever

The private equity industry has optimized nearly everything—deal sourcing, portfolio company operations, and exit timing. But one critical lever remains painfully underdeveloped: Investor Experience.

As Shalaka Uchil, Director of Global Capital at Antler, puts it: "The investor experience matters a lot. LPs remember their first fund experience, especially since we often raise another fund in three to four years. Getting it right the first time is key to bringing them back."

The Gap Between Expectation and Reality

The gap has never been wider. LPs routinely encounter fragmented dashboards, hidden action items, and email chains that disappear into the void. Meanwhile, their experience with consumer products—from banking apps to investment platforms—has raised the baseline for what "good" looks like. A PE firm that delivers subscription documents through email and spreadsheets isn't just creating friction. It's signaling operational immaturity.

For LPs, the friction accumulates. Unclear starting points. Hidden pending tasks. The need to manually track multiple entities. Each creates a small moment of frustration that compounds into a poor first impression of the GP.

Once a fund closes, staying connected to LPs becomes exponentially harder. GPs resort to essay-length emails or scatter URLs across multiple platforms, forcing LPs to hunt through their inboxes. This isn't engagement. It's noise.

The result: GPs miss windows to introduce new opportunities, and LPs feel disconnected from the firms they've backed.

How Leading Firms Are Reimagining This Experience

The firms winning capital today share a common operating principle: investor experience is not a feature. It's infrastructure.

This shift manifests in four concrete ways:

1. Clarity Replaces Complexity in Subscription Onboarding

.gif?width=1152&height=528&name=1230(2).gif)

The investor journey in private markets typically begins with one of the most complex tasks: filling out subscription documents. Historically, this was an intimidating, manual, error-prone process.

Modern digital subscription documents redefine that experience. The forms adapt intelligently to investor inputs, showing only the fields that matter and hiding irrelevant ones to reduce cognitive load. Repetitive information is auto-populated, and built-in logic ensures data integrity. Investors can comment or ask for clarification directly within the document—with all conversations organized into a clear, auditable thread.

"The ability to go into any subscription document to help our LPs through the necessary procedures in just a few clicks was incredibly valuable," said Chris Earthman, Managing Director and Co-Founder of NXSTEP.

It's a simple but powerful principle: when LPs know exactly what to do and when to do it, they act with confidence and momentum.

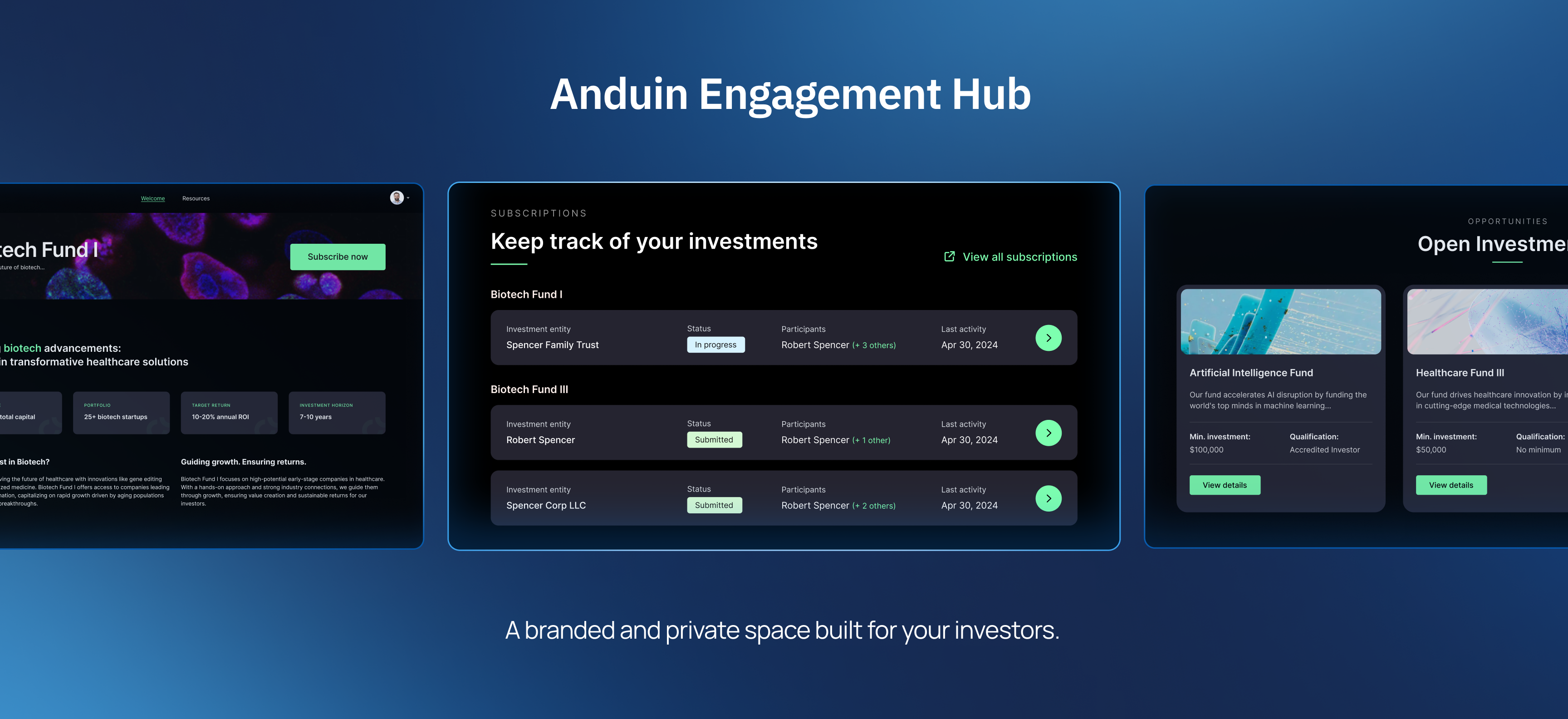

2. Staying Connected After Capital Deployment

The investor journey doesn't end once the subscription form is complete. Staying top of mind with LPs after a fund closes has always challenged IR teams.

An Engagement Hub bridges that gap by providing a private, centralized space for investors to access fund updates, watch webinars, explore reports, and preview new opportunities—all without the noise of traditional inbox-based communication.

Because each page is customizable and permission-controlled, GPs can tailor content to specific investor segments—sharing the right information with the right audience at the right time. This personalized, secure communication layer makes relationship management both scalable and meaningful.

LPs stay informed. GPs stay connected. The conversation continues long after the fund has closed.

3. Data Becomes an Asset, Not a Liability

Experience isn't just about design—it's about data. Without a structured, centralized data layer, personalization and efficiency remain out of reach.

A robust Investor Data Management system provides that foundation by standardizing and organizing investor information into a single source of truth. Returning investors can have their subscription data prefilled, making onboarding a matter of minutes rather than hours.

For firms managing hundreds or thousands of LP relationships, this eliminates manual work while maintaining accuracy and compliance. As Neuberger Berman shared, these capabilities have helped the firm serve a growing investor base "without costing more human effort."

And because this data layer integrates with other systems, it doesn't just make the investor experience smoother—it makes the entire firm smarter.

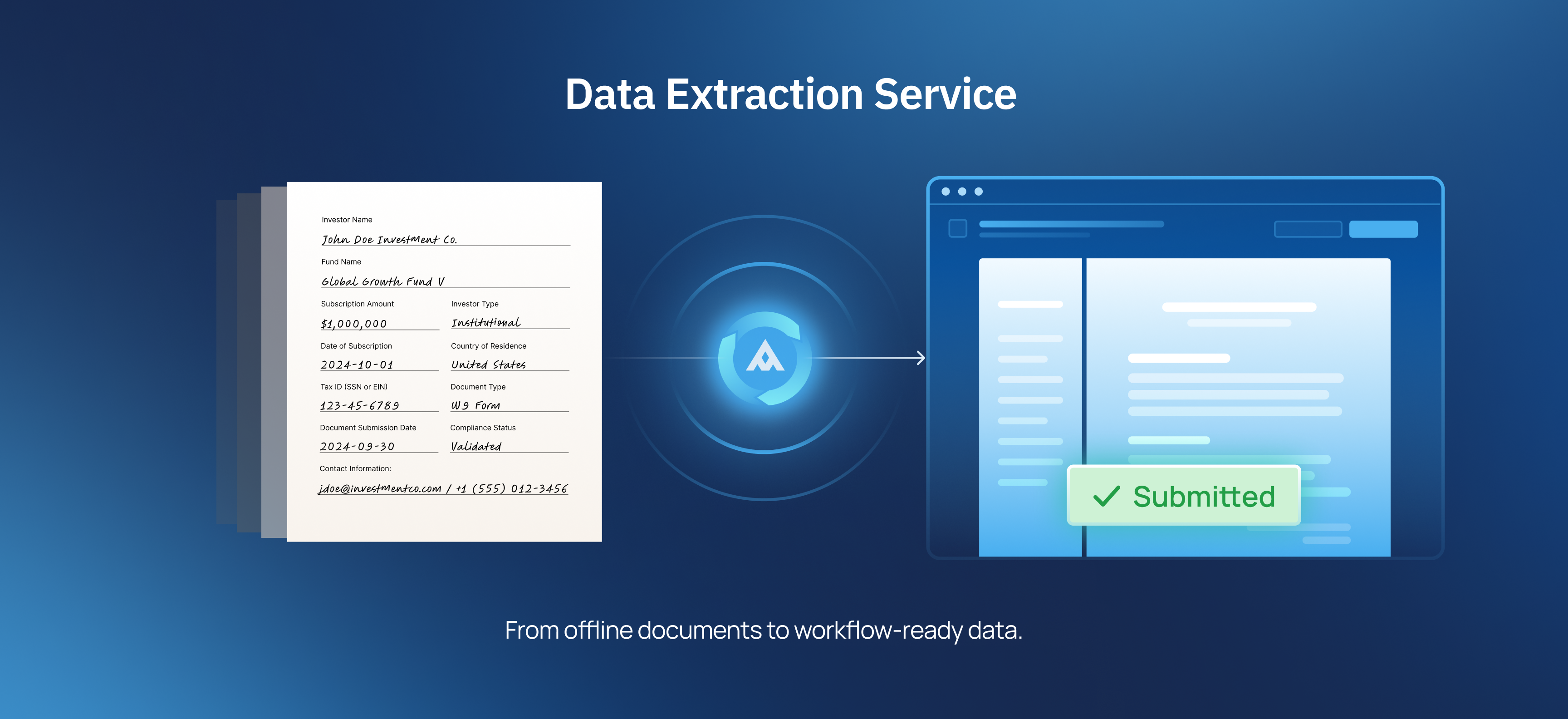

4. Meeting Investors Where They Are

Not every investor lives fully online. Many LPs still rely on traditional document workflows, especially for regulatory or internal policy reasons.

This challenge is solved through integrated OCR capabilities that convert offline documents into workflow-ready digital data. This ensures that even paper-based investors are included in a firm's digital ecosystem—a crucial step toward complete data consolidation and operational transparency.

Inclusivity in investor experience means meeting every LP where they are, without compromising efficiency or accuracy.

Why This Matters Now

Capital is abundant, but attention is scarce. LPs receive multiple fund opportunities simultaneously. Firms that simplify the subscription and engagement experience gain a measurable advantage in deal capture.

First impressions compound over time. LPs who have positive experiences in early interactions are significantly more likely to commit capital to second and third funds. This creates a durable advantage in future fundraising.

Operational quality signals competence. Investors use operational capabilities as a proxy for GP quality. A firm that manages investor data poorly raises questions about portfolio company monitoring and operational discipline.

Digitalization adoption depends on experience. Many firms want to move LPs from paper-based workflows to digital processes. But adoption fails when the digital experience is worse than the analog alternative. Efficient, respectful investor experience is the goal. Digitalization is simply the enabler.

Experience as a Strategic Differentiator

The baseline for "acceptable" investor experience continues to rise. The question isn't whether your firm should prioritize investor experience. The question is how quickly you can move to make it a genuine competitive advantage.

Getting it right means treating investor experience not as a back-office problem, but as a strategic lever—one that shapes capital flows, fund performance perception, and LP retention. The firms doing this are building durable competitive advantages. The firms ignoring it are leaving both capital and relationship equity on the table.

.png)